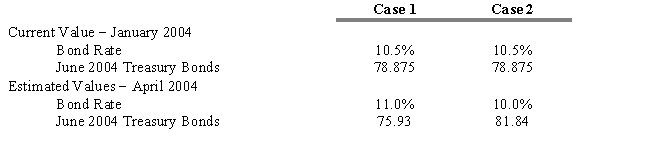

USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

In late January 2004, The Union Cosmos Company is considering the sale of $100 million in 10-year bonds that will probably be rated AAA like the firm's other bond issues. The firm is anxious to proceed at today's rate of 10.5 percent. As treasurer, you know that it will take until sometime in April to get the issue registered and sold. Therefore, you suggest that the firm hedge the pending issue using Treasury bond futures contracts each representing $100,000.

-Refer to Exhibit 15.1. What is the dollar gain or loss assuming that future conditions described in Case 1 actually occur? (Ignore commissions and margin costs.)

Definitions:

Premium

An amount paid in addition to the standard or nominal cost, often associated with insurance or the additional amount above the par value for securities.

IFRS Accounting

The practice of maintaining financial records and reporting financial results in accordance with the International Financial Reporting Standards.

U.S.GAAP

U.S.GAAP (United States Generally Accepted Accounting Principles) comprises a broad set of accounting standards developed by the Financial Accounting Standards Board (FASB) used for preparing financial statements in the U.S.

Contingencies

Potential liabilities or gains that may occur in the future, dependent on the outcome of a specific event.

Q10: In evaluating bond performance, the Barclays Aggregate

Q40: The gross return of closed-end investments companies

Q50: Calculate the annual rate of return for

Q65: Samurai bonds are yen-denominated bonds sold in

Q98: A put option is in the money

Q103: Suppose you have a 15 percent, 25-year

Q104: Which of the following performance measures is

Q107: Interest rate anticipation is the most conservative

Q125: Estimate the percentage price change for a

Q135: If you have entered into a currency