USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

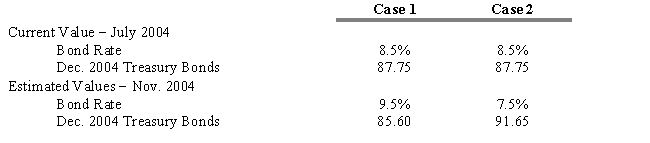

Assume you are the Treasurer for the Johnson Pharmaceutical Company and in late July 2004, the company is considering the sale of $500 million in 20-year bonds that will most likely be rated the same as the firm's other debt issues. The firm would like to proceed at the current rate of 8.5%, but you know that it will probably take until November to bring the issue to market. Therefore, you suggest that the firm hedge the pending issue using Treasury bond futures contracts, which each represent $100,000.

-Refer to Exhibit 15.2. How you would go about hedging the bond issue?

Definitions:

Possible Causes

Factors or conditions that can bring about a particular phenomenon or outcome.

Motor Development

The gradual progression of muscle control, movement skills, and physical coordination in infants and children.

Middle Childhood

A developmental stage that typically encompasses the ages of 6-12 years, characterized by significant growth and development in social, cognitive, and emotional areas.

Sex Differences

Refers to the biological and physiological distinctions between males and females, often influencing physical, cognitive, and behavioral aspects.

Q2: A manager's superior returns could have occurred

Q16: Refer to Exhibit 14.1. If Bruce buys

Q17: A function your portfolio manager may perform

Q23: Assume the exchange rate is GBP 1.35/USD,

Q26: Refer to Exhibit 13.3. Calculate the current

Q44: Refer to Exhibit 13.7. The dollar investment

Q52: The entity that acts as the guarantor

Q71: Whenever a buyer and a seller agree

Q90: In the Characteristic Selectivity (CS) performance measure,<br>A)

Q105: Refer to Exhibit 15.12. If the futures