USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

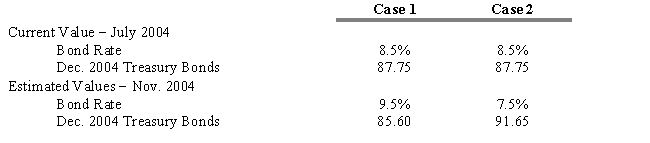

Assume you are the Treasurer for the Johnson Pharmaceutical Company and in late July 2004, the company is considering the sale of $500 million in 20-year bonds that will most likely be rated the same as the firm's other debt issues. The firm would like to proceed at the current rate of 8.5%, but you know that it will probably take until November to bring the issue to market. Therefore, you suggest that the firm hedge the pending issue using Treasury bond futures contracts, which each represent $100,000.

-Refer to Exhibit 15.2. What is the dollar gain or loss assuming that future conditions described in Case 1 actually occur? (Ignore commissions and margin costs .)

Definitions:

Human Resource Planning

Identifying the numbers and types of employees the organization will require in order to meet its objectives.

Forecasting

The attempts to determine the supply of and demand for various types of human resources to predict areas within the organization where there will be labor shortages or surpluses.

Recruitment Sources

The various channels or methods through which potential job candidates can be identified, contacted, and attracted to apply for positions within an organization.

Personnel Policies

Guidelines and rules set by an organization to govern its human resource practices and manage its employees.

Q3: A manager following an interest rate anticipation

Q17: A function your portfolio manager may perform

Q29: A benchmark portfolio is defined as a

Q35: Which of the following is a characteristic

Q37: If the coupon payments are not reinvested

Q40: Forward contracts do not require an upfront

Q51: The basis (B<sub>t,T</sub>) at time t between

Q72: Risk management strategies involving interest rate agreements

Q77: While LIBOR is usually used with forward

Q106: The promised yield to maturity calculation assumes