USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

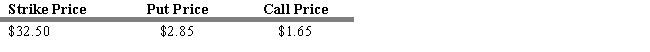

Consider the following information on put and call options for Citigroup

-Refer to Exhibit 16.4. A covered call is an appropriate strategy if

Definitions:

Probate

A legal process that deals with the assets and debts of a deceased person, ensuring proper distribution according to the will or the law.

Resided

To have been domiciled or located in a particular place.

Trust's Principal

The original assets placed into a trust by the grantor, excluding any income or appreciation generated by those assets.

Investment Costs

Investment costs include all the expenses associated with acquiring an asset, including purchase price, broker fees, setup costs, and any other costs necessary to bring the asset to a usable state.

Q5: Assume that you manage an equity portfolio.

Q8: Define a sole proprietorship.

Q20: The pure expectations hypothesis suggests futures prices

Q21: Refer to Exhibit 15.3. If 90-day LIBOR

Q31: Which of the following are functions that

Q33: Of the different types of businesses,a corporation

Q44: A call option in which the stock

Q71: Whenever a buyer and a seller agree

Q98: Treynor showed that rational, risk-averse investors always

Q115: Refer to Exhibit 13.11. Calculate the percentage