USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

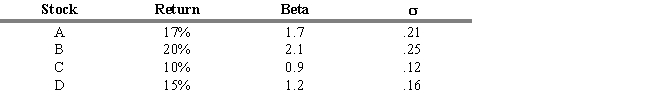

An analyst is considering investing in funds A, B, C, and D. The market portfolio, M, is expected to be 11 percent next period, and the risk-free rate of return is 3 percent. The market portfolio had a standard deviation over the past ten years of 0.20. The analyst gathered the following information on the four funds.

-Refer to Exhibit 18.8. Rank the four funds and market portfolio in order from highest to lowest based on their Treynor performance measures.

Definitions:

Proliferative

Relating to the rapid multiplication of cells or tissue.

Impaired Skin Integrity

A disruption in the normal structure and function of the skin, leading to an increased risk of injury or infection.

Nonblanchable Erythema

Reddening of the skin that does not lighten or turn white (blanch) when pressure is applied, often indicating stage I pressure injury.

Granulation Tissue

New vascular tissue formed on the surface of a healing wound, indicating the process of healing.

Q2: The principal-agent problem is a problem<br>A)caused by

Q23: The first example of comparative advantage appeared

Q48: Consider the Compliance Bond Fund that consists

Q57: High portfolio turnover lowers mutual fund costs.

Q58: Net asset value (NAV) is determined by<br>A)

Q71: All of the following are normal characteristics

Q88: Suppose a decrease in the supply of

Q101: Refer to Figure 9-3.What is the value

Q107: Refer to Exhibit 15.18. Suppose that three-month

Q136: If at a price of $10,a vendor