USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

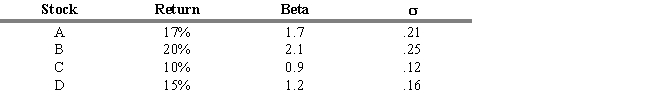

An analyst is considering investing in funds A, B, C, and D. The market portfolio, M, is expected to be 11 percent next period, and the risk-free rate of return is 3 percent. The market portfolio had a standard deviation over the past ten years of 0.20. The analyst gathered the following information on the four funds.

-Refer to Exhibit 18.8. Compute the Jensen Measure for the C fund.

Definitions:

Critical Values

Threshold values on the scale of a test statistic beyond which the null hypothesis is rejected.

Variables

Any characteristics, number, or quantity that can be measured or counted.

Pearson Correlation

A measure of the linear correlation between two variables, ranging from -1 to 1, where 1 is total positive linear correlation, 0 is no linear correlation, and -1 is total negative linear correlation.

Critical Values

Thresholds in statistical testing that delineate areas where the test statistic leads to the rejection or acceptance of the null hypothesis.

Q7: The Chicago Board Options Exchange has the

Q14: On a balance sheet<br>A)total assets must equal

Q46: Refer to Figure 9-1.Under autarky,the equilibrium price

Q61: According to Global Investment Performance Standards (GIPS),

Q70: Refer to Exhibit 15.9. If the futures

Q91: Who controls a partnership?<br>A)stockholders<br>B)bondholders<br>C)the owner s<br>D)all of

Q93: The conversion premium for a convertible bond

Q103: Refer to Figure 9-2.The tariff revenue collected

Q129: Which of the following statements is true?<br>A)If

Q134: You have a bond that pays $60