USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

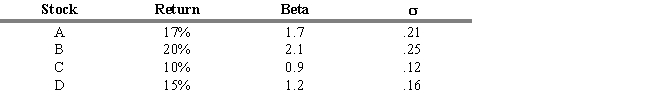

An analyst is considering investing in funds A, B, C, and D. The market portfolio, M, is expected to be 11 percent next period, and the risk-free rate of return is 3 percent. The market portfolio had a standard deviation over the past ten years of 0.20. The analyst gathered the following information on the four funds.

-Refer to Exhibit 18.8. Rank the four funds and market portfolio in order from highest to lowest based on their Treynor performance measures.

Definitions:

Insurer's Duty

The obligations and standards of conduct expected from an insurance company, including acting in good faith and handling claims fairly.

Innocent Misrepresentation

A false statement made without malice or knowledge of its falsity, often leading to a misunderstanding in a contract or agreement.

Wagering Contract

An agreement between parties where the outcome is based on an uncertain event, in which one party stands to win or lose something of value.

Insurance Contract

A legally binding agreement between an insurer and the policyholder, specifying the claims which the insurer is legally required to pay in exchange for an initial payment, known as the premium.

Q11: Duration is considered a good measure of

Q27: The Sortino measure differs from the Sharpe

Q29: Refer to Exhibit 15.3. What is the

Q53: If you own a $1,000 face value

Q58: Refer to Exhibit 15.3. Assuming the yields

Q65: In the absence of arbitrage opportunities, the

Q65: Facebook is an example of a private

Q82: If a corporate bond with face value

Q94: Because consumers who have insurance provided by

Q102: Health insurance markets have a problem with