USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S)

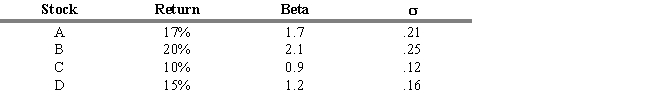

An analyst is considering investing in funds A, B, C, and D. The market portfolio, M, is expected to be 11 percent next period, and the risk-free rate of return is 3 percent. The market portfolio had a standard deviation over the past ten years of 0.20. The analyst gathered the following information on the four funds.

-Refer to Exhibit 18.8. Compute the Jensen Measure for the C fund.

Definitions:

Circle

A simple closed shape consisting of all points in a plane that are a given distance from a given point, the centre.

Cartel

An association of independent firms or countries that agree to coordinate their production and pricing to monopolize a market or to influence market conditions.

Q12: Refer to Table 9-2.Fill in the following

Q46: In the United States,corporate profits are taxed<br>A)only

Q59: The typical proxy for the market portfolio

Q61: Refer to Exhibit 15.7. What will the

Q67: Refer to Exhibit 16.7. Calculate the net

Q73: Two consequences of asymmetric information are adverse

Q74: Under current U.S.tax laws individuals do not

Q80: To calculate the price elasticity of demand

Q100: By attaching a convertible feature to a

Q104: In May 2011,the average price of gasoline