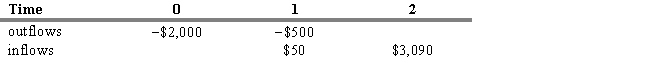

A portfolio manager has the following sequence of cash flows over a two-year period:  Calculate the portfolio manager's dollar weighted return.

Calculate the portfolio manager's dollar weighted return.

Definitions:

Shares of the Business

Equity units of a corporation that represent ownership interest held by shareholders, giving them a claim on the company's profits in the form of dividends.

Stock

A type of financial security that signifies ownership in a corporation and represents a claim on part of the corporation's assets and earnings.

Q1: In 1930,the U.S.government attempted to help domestic

Q26: Refer to Exhibit 15.16. Assuming that three-month

Q44: Adverse selection in the market for health

Q48: In 1995,the General Agreement on Tariffs and

Q58: Domestic producers require time to gain experience

Q75: Some economists have argued that certain characteristics

Q92: One of the main sources of comparative

Q96: A long-strip position indicates that an investor

Q105: Refer to Exhibit 15.12. If the futures

Q136: If at a price of $10,a vendor