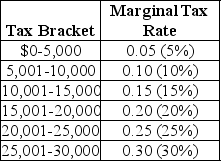

Last year,Anthony Millanti earned exactly $30,000 of taxable income.Assume that the income tax system used to determine Anthony's tax liability is progressive.The table below lists the tax brackets and the marginal tax rates that apply to each bracket.

a.Draw a new table that lists the amounts of income tax that Anthony is obligated to pay for each tax bracket,and the total tax he owes the government.(Assume that there are no allowable tax deductions,tax credits,personal exemptions or any other deductions that Anthony can use to reduce his tax liability).

b.Determine Anthony's average tax rate.

Definitions:

Organizational Culture

The shared values, beliefs, norms, and practices that characterise an organisation, influencing its members' behavior and contributing to the unique social and psychological environment of the organization.

Organizational Identity

The self-conceived and expressed image of an organization, embodying its values, beliefs, and priorities.

Harley-Davidson

A motorcycle manufacturer from the United States, famous for producing heavy motorcycles intended for highway cruising.

Organizational Culture

A collection of common values, beliefs, and standards that affect how employees perceive, feel, and act within a corporation.

Q5: Unlike a perfect competitor,a monopolist faces the

Q10: For a given supply curve,how does the

Q45: What is cost-plus pricing? Why do some

Q54: To increase gas mileage,automobile manufacturers make cars

Q60: Mel's House of Cars is an automobile

Q62: _ is defined as a market outcome

Q66: What is deadweight loss? When is deadweight

Q93: If Mort's House of Flowers sells one

Q94: Which of the following is the largest

Q122: Izzy Amador is a highly talented tattoo