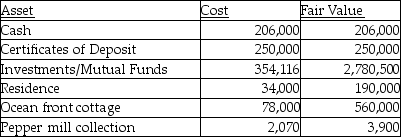

John Doe's will states that all assets he had should be transferred to a trust to cover living expenses for his spouse, who he feels will not be able to handle her own financial affairs without advice and supervision.Upon his spouse's passing, the trust will be converted to cash and distributed to their only daughter, Jane.The probate court already ruled on which assets could be excluded from the estate, and all tax issues were addressed, leaving the following inventory of assets from the estate:

Required:

Required:

Prepare the journal entry for the creation of the trust.

Definitions:

Marginal Revenue

is the additional income generated from selling one more unit of a product or service, crucial for understanding profitability and making production decisions.

Economic Profit

The difference between total revenue and total costs, including both explicit and opportunity costs, reflecting the additional gain or loss from a business decision.

Average Total Cost

The cost of producing each unit, calculated by dividing the overall production cost by the quantity of units made.

Marginal Cost

The extra expense that arises when one more unit of a product or service is produced.

Q10: Jeale Corporation is preparing its interim financial

Q12: Leotronix Corporation estimates its income by calendar

Q13: Ohio Corporation is being liquidated under Chapter

Q17: On November 1, 2011, Portsmith Corporation, a

Q19: Meric Corporation (a U.S.company)began operations on January

Q22: Identify the fund type of the fund

Q28: The following table is provided in the

Q60: Refer to Figure 1-3.Calculate the area of

Q97: Define allocative efficiency.Explain the significance of this

Q106: Refer to Figure 10-4.If the price of