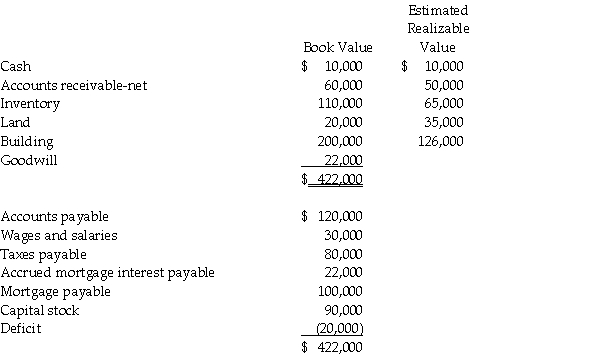

Alitech Corporation is liquidating under Chapter 7 of the Bankruptcy Act.The accounts of Alitech at the time of filing are summarized as follows:

The land and building are pledged as security for the mortgage payable as well as any accrued interest on the mortgage.Wages and salaries were earned within 90 days of filing the petition for bankruptcy and do not exceed $10,000 per employee.Liquidation expenses are expected to be $30,000.

The land and building are pledged as security for the mortgage payable as well as any accrued interest on the mortgage.Wages and salaries were earned within 90 days of filing the petition for bankruptcy and do not exceed $10,000 per employee.Liquidation expenses are expected to be $30,000.

Required:

1.Prepare a schedule showing the priority rankings of the creditors and the expected payouts.

2.Billing Corporation was a supplier to Alitech Corporation and at the time of Alitech's bankruptcy filing, Billing's account receivable from Alitech was $40,000.On the basis of the estimates, how much can Billing expect to receive?

Definitions:

Articles of Organization

The document filed with a state governmental body to legally form a limited liability company (LLC).

Noncorporate Business Organization

Any form of business entity that is not incorporated, such as partnerships, sole proprietorships, and limited liability companies, where the legal and tax characteristics may differ from those of corporations.

Separate Taxable Entity

An entity that is recognized as separate from its owners for tax purposes, such as a corporation, and therefore must file its own tax returns.

Ownership Interest

A portion or share in the ownership of assets, such as real estate or a company, affording the holder certain rights like income or control.

Q2: Which of the following does not occur

Q17: On January 1, 2011, the General Fund

Q19: Note to Instructor: This exam item is

Q27: Pigeon Company owns 80% of the outstanding

Q37: At December 31, 2010, the stockholders' equity

Q51: Refer to Table 1-1.What is Eva's marginal

Q59: Which of the following is a microeconomics

Q78: Refer to Figure 10-5.If the consumer has

Q101: If it costs Vijay $150 to design

Q113: Suppose when the price of hybrid automobiles