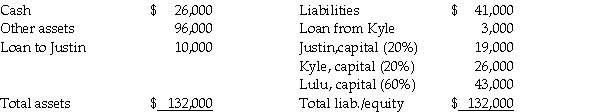

The Justin, Kyle, and Lulu partnership was dissolved by the partners on May 1, 2011.Their balance sheet on that date is shown below:

In May, other assets with a book value of $46,000 were sold for $50,000 in cash.

In May, other assets with a book value of $46,000 were sold for $50,000 in cash.

Required:

Determine how the available cash on May 31, 2011 will be distributed.

Definitions:

Training Employees

The process of enhancing the skills, knowledge, and competencies of staff within an organization to improve their job performance.

Business Relationship

A connection between two or more entities involved in commercial transactions or partnerships, characterized by mutual goals, communication, and often, contractual agreements.

Funeral Home

A business establishment that provides services related to the burial, cremation, and memorialization of deceased individuals.

Foreign Markets

The markets outside the domestic boundaries of a country where businesses seek to expand their operations and sales.

Q1: Phim Inc., a U.S.company, owns 100% of

Q1: At January 1, 2010, the stockholders' equity

Q21: Cass Corporation's balance sheet at December 31,

Q21: A Capital Projects Fund awards the construction

Q27: On March 1, 2011, Amber Company sold

Q30: If the bonds were originally issued at

Q32: What is the amount of consolidated Retained

Q32: Assume you are preparing journal entries for

Q54: The term "market" refers only to trading

Q101: If it costs Vijay $150 to design