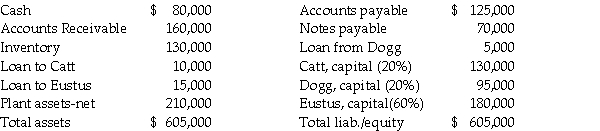

The Catt, Dogg, and Eustus partnership was dissolved by the partners in early 2011.On March 1, the partners prepared the following financial statement before commencement of final liquidation:

Liquidation events in March were as follows:

Liquidation events in March were as follows:

- Receivables recorded at $120,000 were collected at $110,000;

- Inventory recorded at cost of $80,000 was sold for $60,000;

- Plant assets with a book value of $100,000 were sold for $140,000.

Required:

Determine how the available cash on March 31, 2011 should be distributed.

Definitions:

Income

Money received, especially on a regular basis, for work or through investments.

Market

A place or system where buyers and sellers interact to exchange goods, services, or information, often determined by supply and demand.

Negotiation

The process of discussion aimed at reaching an agreement or compromise between two or more parties.

Win-lose

A situation or outcome in which one party's gain results directly from another party's loss, often seen in competitive or adversarial scenarios.

Q4: A subsidiary has dilutive securities outstanding that

Q9: Padma Corporation owns 70% of the outstanding

Q10: The key focus of government fund accounting

Q11: Packer Corporation owns 100% of Abel Corporation,

Q23: The consolidated income statement for Pouch Corporation

Q25: Old West City had the following transactions

Q33: Consider a sale of stock by a

Q36: Savy Corporation's stockholders' equity on December 31,

Q37: An increase in income results in an

Q41: Which of the following is motivated by