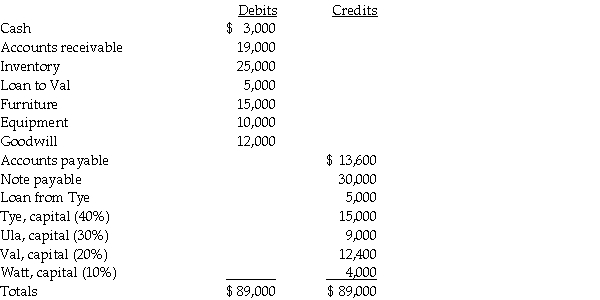

Tye, Ula, Val, and Watt are partners who share profits and losses 40%, 30%, 20%, and 10%, respectively.The partnership will be liquidated gradually over several months beginning January 1, 2011.The partnership trial balance at December 31, 2010 is as follows:

Required:

Required:

Prepare a cash distribution plan for January 1, 2011, showing how cash installments will be distributed among the partners as it becomes available.Prepare vulnerability rankings for the partners and a schedule of assumed loss absorption.

Definitions:

Units Bought

The quantity of a product that consumers purchase at a given price.

Tax Imposed

A financial charge or other levy instituted by a government on an individual or an entity to raise revenue for public purposes.

Deadweight Loss

An economic efficiency loss that occurs when market equilibrium is not achieved or when externalities are present, leading to a loss of total welfare.

Deadweight Loss

A loss of economic efficiency that can occur when the equilibrium for a good or service is not achieved or is unattainable.

Q5: Anna and Bess share partnership profits and

Q18: Fresh-start reporting results in<br>A) a new reporting

Q18: There are several theories for allocating constructive

Q31: On January 5, 2011, Eagle Corporation paid

Q33: Under GAAP, the _ will include the

Q33: Spott is a 75%-owned subsidiary of Penthal.On

Q34: A U.S.parent corporation loans funds to a

Q35: Plover Corporation acquired 80% of Sink Inc.equity

Q91: The number of people who have gray

Q147: Which of the following is held constant