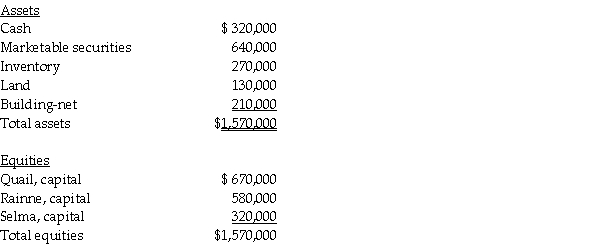

A summary balance sheet for the partnership of Quail, Rainne and Selma on December 31, 2011 is shown below.Partners Quail, Rainne and Selma allocate profit and loss in their respective ratios of 6:3:1.

The partners agree to admit Trask for a one-tenth interest.The fair market value for partnership land is $260,000, and the fair market value of the inventory is $370,000.

The partners agree to admit Trask for a one-tenth interest.The fair market value for partnership land is $260,000, and the fair market value of the inventory is $370,000.

Required:

1.Record the entry to revalue the partnership assets prior to the admission of Trask.

2.Calculate how much Trask will have to invest to acquire a 10% interest.

3.Assume the partnership assets are not revalued.If Trask paid $300,000 to the partnership in exchange for a 10% interest, what would be the bonus that is allocated to each partner's capital account?

Definitions:

Cost of Capital

The obligatory profit percentage a corporation needs to achieve on its investments to keep its market share and attract investors.

IRR

Internal Rate of Return; a financial metric used to evaluate the profitability of investments, representing the discount rate that makes the net present value (NPV) of all cash flows equal to zero.

Net Cash Flows

The difference between a company's cash inflows and outflows during a specific period, representing its ability to generate value.

Depreciation

The accounting entry allocating the cost of a long-lived asset against income over the asset’s life. Depreciation is a noncash charge, so net income is generally less than true cash flow by at least the amount of depreciation.

Q5: Southtown Community Hospital (SCH)shows the following balances

Q6: Government-wide financial statements exclude the<br>A) general fund.<br>B)

Q7: Pacini Corporation owns an 80% interest in

Q8: The four cash flow categories required in

Q16: Pexo Industries purchases the majority of their

Q18: The gift shop of a nonprofit, private

Q23: The controlling interest share of consolidated net

Q30: Ulysses Company purchases goods from China amounting

Q35: Which of the following phrases is frequently

Q70: When goods and services are produced at