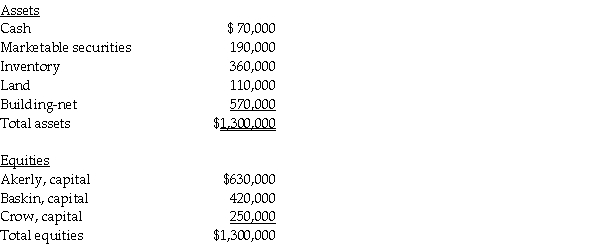

A summary balance sheet for the Akerly, Baskin, and Crow partnership on December 31, 2011 is shown below.Partners Akerly, Baskin, and Crow allocate profit and loss in their respective ratios of 3:2:1.The partnership agreed to pay partner Baskin $500,000 for his partnership interest upon his retirement from the partnership on January 1, 2012.The partnership financials on January 1, 2012 are:

Required:

Required:

Prepare the journal entry to reflect Baskin's retirement from the partnership:

1.Assuming a bonus to Baskin.

2.Assuming a revaluation of total partnership capital based on excess payment.

3.Assuming goodwill equal to the excess payment is recorded.

Definitions:

Psychological Attribute

An inherent characteristic or quality of an individual's mind or personality, such as temperament, intelligence, or emotional responses.

Leadership Traits

Characteristics and qualities that are effective for leading and influencing others, such as charisma, decisiveness, and integrity.

Influencing Factor

An element or aspect that can sway, affect, or alter the outcome of a decision, situation, or behavior.

Authentic Leadership

A leadership style characterized by self-awareness, transparency, ethical/moral behavior, and openness, fostering genuine connections with followers.

Q2: Proceeds from bonds issued for the construction

Q7: Porter Corporation acquired 70% of the outstanding

Q11: On June 1, 2011, Puell Company acquired

Q17: All of the following questions or statements

Q18: Assume a company's preferred stock is cumulative

Q29: Static City started a department to provide

Q30: A U.S.firm has a Belgian subsidiary that

Q31: If Bird uses a "beginning-of-the-year" sale assumption,

Q33: Childrens Hospital is a private, not-for-profit hospital.The

Q64: If the price of milk was $1.25