Use the following information to answer the question(s) below.

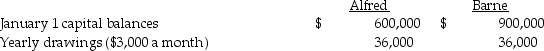

Alfred and Barne share profits and losses in a ratio of 2:3, respectively, after salary allowances, interest allowances and bonus allocations. Alfred and Barne receive salary allowances of $30,000 and $60,000, respectively, and both partners receive 10% interest based upon the balance in their capital accounts on January 1. Partners' drawings are not used in determining the average capital balances. Total net income for 2014 is $180,000. If net income after deducting the interest and salary allocations is more than $60,000, Barne receives a bonus of 5% of the original amount of net income.

-What is the total amount for the allocation of interest,salary,and bonus,and how much over-allocation is present?

Definitions:

Forfeited Shares

Shares that have been surrendered or given up by the shareholder, often due to non-payment of share allotment or call money.

Refundable

Describes money that can be returned to the payer, often seen in tax credits or deposits that can be reclaimed under specific conditions.

Financial Statements

Documents outlining the financial activities and condition of a business, organization, or individual, typically including the balance sheet, income statement, and cash flow statement.

Asset Revaluation

The process of adjusting the book value of a company's assets to reflect their current fair market values.

Q3: In reference to the probate process, which

Q9: Illiana Corporation has several accounting issues with

Q9: In the market for factors of production,households

Q13: Parrot Corporation acquired a 70% interest in

Q18: Pollek Corporation paid $16,200 for a 90%

Q31: Thoroughgood County has a municipal golf course

Q35: An elimination entry at December 31, 2011

Q37: An increase in income results in an

Q93: Refer to Figure 1-2.Calculate the area of

Q135: Productive efficiency is achieved when firms produce