Use the following information to answer the question(s) below.

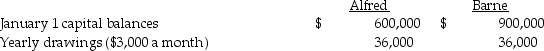

Alfred and Barne share profits and losses in a ratio of 2:3, respectively, after salary allowances, interest allowances and bonus allocations. Alfred and Barne receive salary allowances of $30,000 and $60,000, respectively, and both partners receive 10% interest based upon the balance in their capital accounts on January 1. Partners' drawings are not used in determining the average capital balances. Total net income for 2014 is $180,000. If net income after deducting the interest and salary allocations is more than $60,000, Barne receives a bonus of 5% of the original amount of net income.

-If the partnership experiences a net loss of $60,000 for the year,what will be the final net amount of profit or (loss) closed to each partner's capital account?

Definitions:

Equilibrium Quantity

Equilibrium quantity is the amount of goods or services supplied and demanded at the equilibrium price, where market supply and demand balance each other.

Wage Subsidy

A financial incentive provided by the government to businesses to encourage the hiring of more employees or to reduce unemployment.

Earned Income Tax Credit

A tax credit that can be refunded, designed for individuals and families of low to moderate income, especially those with children, to help lessen poverty and promote employment.

Bribery

The act of offering, giving, receiving, or soliciting something of value as a means of influencing the actions of an individual in a position of power or authority.

Q1: Anthony and Cleopatra create a joint venture

Q5: If Bird uses the "actual-sale-date" sales assumption,

Q9: A summary balance sheet for the Uma,

Q10: Note to Instructor: This exam item is

Q12: On December 18, 2011, Wabbit Corporation (a

Q14: What should be the noncontrolling interest share,

Q14: Paulee Corporation paid $24,800 for an 80%

Q25: Par Industries, a U.S.Corporation, purchased Slice Company

Q31: Paula's Pizzas purchased 80% of their supplier,

Q40: Selling tickets to graduation ceremonies has long