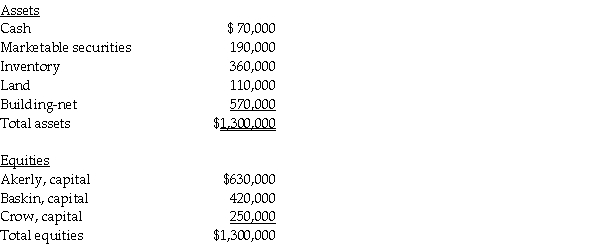

A summary balance sheet for the Akerly, Baskin, and Crow partnership on December 31, 2011 is shown below.Partners Akerly, Baskin, and Crow allocate profit and loss in their respective ratios of 3:2:1.The partnership agreed to pay partner Baskin $500,000 for his partnership interest upon his retirement from the partnership on January 1, 2012.The partnership financials on January 1, 2012 are:

Required:

Required:

Prepare the journal entry to reflect Baskin's retirement from the partnership:

1.Assuming a bonus to Baskin.

2.Assuming a revaluation of total partnership capital based on excess payment.

3.Assuming goodwill equal to the excess payment is recorded.

Definitions:

Brokerages

Firms that act as intermediaries between buyers and sellers in financial transactions, often involving stocks, bonds, or real estate.

Primary Market

The market segment at which a company's products or services are primarily aimed, often defined by demographics such as age, gender, or income.

Interest Rate

The percentage of an amount of money charged for its use over a specified period of time, typically expressed on an annual basis.

Credit Unions

Cooperative financial institutions owned and controlled by their members, providing savings accounts, loans, and other financial services to members.

Q4: Gains or losses on foreign currency transactions

Q5: Which of the following hedging strategies would

Q5: The government makes all economic decisions in

Q16: Pardo Corporation paid $140,000 for a 70%

Q16: Match each of the following descriptions with

Q19: Note to Instructor: This exam item is

Q22: From the standpoint of accounting theory, which

Q24: Maxtil Corporation estimates its income by calendar

Q36: The balance sheet of the Flail, Gail,

Q40: Selling tickets to graduation ceremonies has long