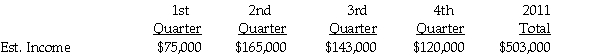

Nettle Corporation is preparing its first quarterly interim report.It is subject to a corporate income tax rate of 20% on the first $50,000 of taxable income and 35% on taxable income above $50,000.Its estimated pretax accounting income for 2011, by quarter, is:

Nettle expects to earn and receive operating income for the year and does not contemplate any changes in accounting procedures or principles that would affect its pretax accounting income.

Nettle expects to earn and receive operating income for the year and does not contemplate any changes in accounting procedures or principles that would affect its pretax accounting income.

Required:

1.Determine Nettle's estimated effective tax rate for 2011.

2.Prepare a schedule to show Nettle's estimated net income for each quarter of 2011.

Definitions:

Startle

A quick, automatic response to a sudden unexpected stimulus, often characterized by jerking bodily motions.

Drainage

The removal of fluids from a body cavity, wound, or other source, often for therapeutic reasons.

Ear Infections

Infections that occur in the ear, often in the middle ear, leading to pain, fever, and sometimes hearing difficulty.

Otoscopic Examination

A visual examination of the ear canal and eardrum using an otoscope, an instrument designed for looking into the ear canal.

Q14: If a U.S.company is preparing a journal

Q22: Palomba Corporation allocates consolidated income taxes to

Q24: The balance sheet of the Addy, Bess,

Q29: On January 1, 2011, Fly Corporation held

Q30: In a Chapter 11 case, the debtor

Q31: Jabiru Corporation purchased a 20% interest in

Q36: Controlling interest share of consolidated net income

Q38: If the sale of the merchandise was

Q114: "The distribution of income should be determined

Q119: Examining the conditions that could lead to