Note to Instructor: This exam item is similar to Exercise 3 except that the exchange rates have been changed and the temporal method is used instead of the current rate method.

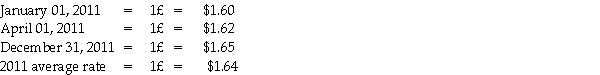

The Polka Corporation, a U.S.corporation, formed a British subsidiary on January 1, 2011 by investing 550,000 British pounds (£)in exchange for all of the subsidiary's no-par common stock.The British subsidiary, Stripe Corporation, purchased real property on April 1, 2011 at a cost of £500,000, with £100,000 allocated to land and £400,000 allocated to the building.The building is depreciated over a 40-year estimated useful life on a straight-line basis with no salvage value.The U.S.dollar is Stripe's functional currency, but it keeps its records in pounds.The British economy does not experience high rates of inflation.Exchange rates for the pound on various dates are:

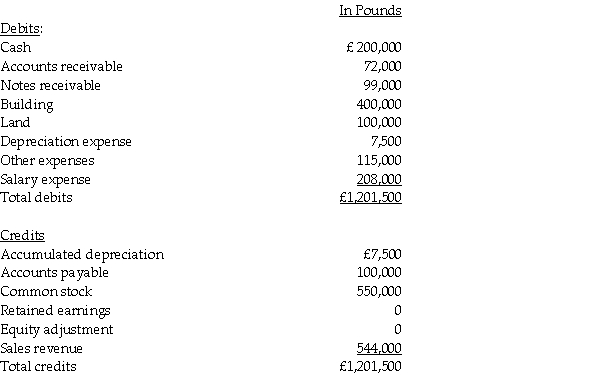

Stripe's adjusted trial balance is presented below for the year ended December 31, 2011.

Stripe's adjusted trial balance is presented below for the year ended December 31, 2011.

Required: Prepare Stripe's:

Required: Prepare Stripe's:

1.Remeasurement working papers;

2.Remeasured income statement; and

3.Remeasured balance sheet.

Definitions:

Socialization

The process by which children learn the behaviors, attitudes, and expectations required of them by their society or culture.

Placenta

An organ that develops in the uterus during pregnancy, providing oxygen and nutrients to and removing waste from the fetus through the umbilical cord.

Zygote

The initial cell formed when a new organism is conceived by the union of an egg and a sperm cell, containing genetic information from both parents.

Testosterone

A steroid hormone that plays a key role in the development of male reproductive tissues as well as promoting secondary sexual characteristics such as increased muscle and bone mass, and the growth of body hair.

Q1: Pierce Manufacturing owns all of the outstanding

Q7: If an affiliate purchases bonds in the

Q10: The gain from the bond purchase that

Q10: A forward contract used as a cash

Q12: Which of the following must approve a

Q12: Pan Corporation, a U.S.company, formed a British

Q23: Pickle Incorporated acquired a $10,000 bond originally

Q31: Jabiru Corporation purchased a 20% interest in

Q77: Refer to Scenario 1-1.Using marginal analysis terminology,what

Q124: Which of the following are positive economic