Use the following information to answer the question(s) below.

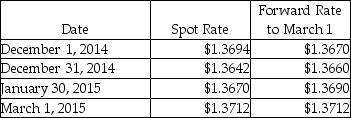

On December 1, 2014, Thomas Company, a U.S. corporation, purchases inventory from a vendor in Italy for 400,000 euros. Payment is due in 90 days. To hedge the transaction, Thomas signs a forward contract to buy 400,000 euros in 90 days at $1.3670. Thomas uses a discount rate of 6% (present value factor for 30 days = .9950; 60 days = .9901; 90 days = .9851) . Assume the forward contract will be settled net and this is a cash flow hedge. Currency exchange rates are shown below:

-What is the fair value of the forward contract at January 30?

Definitions:

Threshold

The point of intensity at which a stimulus begins to produce a sensation or elicit a response, marking the limit between the absence and the beginning of a perception.

Membrane Potential

The difference in electric potential between the interior and the exterior of a biological cell.

Action Potential

A rapid change in electrical potential across a cell's membrane that occurs when a neuron sends information down an axon.

Synapse

The junction between two neurons or a neuron and a muscle or gland cell, where electrical or chemical signals are transmitted.

Q1: A primary difference between voluntary and involuntary

Q6: The estimated taxable income for Shebill Corporation

Q13: Subsequent to an acquisition, the parent company

Q16: Which statement is correct in describing the

Q17: In the business combination of Polka and

Q36: On January 1, 2010, Starling Corporation held

Q37: Shebing Corporation had $80,000 of $10 par

Q74: Which of the following generates allocative efficiency

Q94: Which of the following statements about positive

Q115: Economic models<br>A)make no assumptions in order to