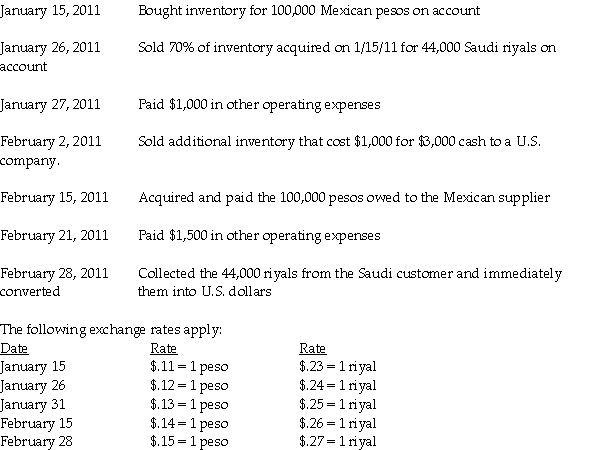

Piel Corporation (a U.S.company)began operations on January 1, 2011, when common stock was issued for $250,000.In the first two months of operations, Piel had the following transactions:

Required:

Required:

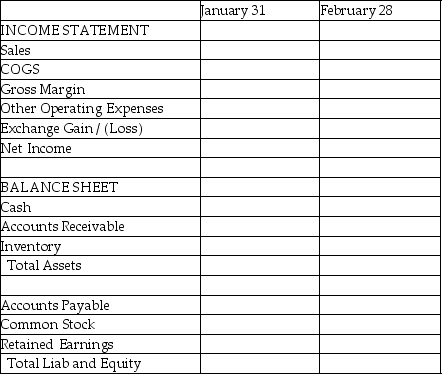

Complete the summary income statement and balance sheet for the month ended January 31, 2011 and February 28, 2011, assuming there were no other transactions.

Definitions:

Partnership

A partnership is a legal form of business operation between two or more individuals who share management and profits. The specific rules can vary depending on the agreement and the jurisdiction.

Profits Share

An agreement or policy where a portion of a company's profits is distributed to employees, shareholders, or partners.

Partnership Act

Legislation that outlines the rights and responsibilities of partners in a business partnership.

Profits

The financial gain realized when the revenue generated from business activities exceeds the expenses, taxes, and costs associated with sustaining the operations.

Q1: Padhy Corporation owns 80% of Abrams Corporation,

Q2: Palmquist Corporation and its 80%-owned subsidiary, Sadler

Q3: In reference to the probate process, which

Q5: Which of the following is not a

Q12: When a capital lease is used to

Q16: The following are transactions for the city

Q33: Greta, Harriet, and Ivy have a retail

Q35: An elimination entry at December 31, 2011

Q36: Pull Incorporated and Shove Company reported summarized

Q182: In the United States,the typical person who