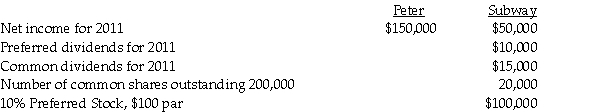

Peter Corporation owns 90% of the common stock of Subsidiary Subway.The following data is available:

The preferred stock is cumulative and convertible.The annual preferred dividends are $10,000.

The preferred stock is cumulative and convertible.The annual preferred dividends are $10,000.

Required:

1.Subway's preferred stock is convertible into 12,000 shares of Subway's common stock.Peter and Subway do not have any other potentially dilutive securities outstanding.

a.What is Subway's basic EPS and diluted EPS?

b.What is consolidated basic EPS and diluted EPS?

2.Subway's preferred stock is convertible into 12,000 shares of Peter's common stock.Peter and Subway do not have any other potentially dilutive securities outstanding.What is consolidated basic EPS and diluted EPS?

Definitions:

Crowding-Out Effect

The phenomenon where increased government spending leads to a reduction in private sector spending and investment due to higher interest rates or other factors.

Government Spending

The total amount of public expenditure by a government, including spending on defense, education, public infrastructure, and welfare programs.

Private Investment

The expenditure on capital goods by private sector firms or individuals in order to generate future income or profits, excluding government spending.

Crowding-In Effect

An increase in private sector spending stimulated by federal budget deficits financed by U.S. Treasury borrowing.

Q3: Palmer Company owns a 25% interest in

Q3: Pawl Corporation acquired 90% of Snab Corporation

Q8: Noncontrolling interest share is viewed as an

Q13: Stello Corporation's stockholders' equity on December 31,

Q21: Paka Corporation owns an 80% interest in

Q25: A 15% stock dividend by a subsidiary

Q27: Which of the following statements about variable

Q33: Oceana Corporation is being liquidated under Chapter

Q215: Suppose the labor force stays constant,and the

Q256: When an economy is at its natural