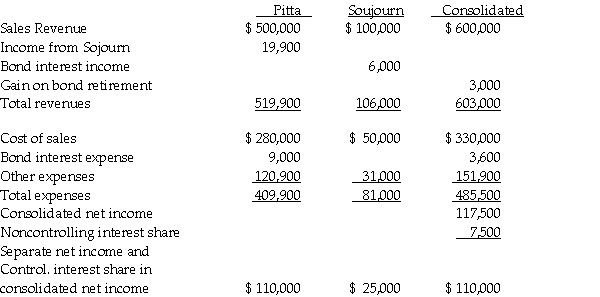

Separate company and consolidated income statements for Pitta and Sojourn Corporations for the year ended December 31, 2011 are summarized as follows:

The interest income and expense eliminations relate to a $100,000, 9% bond issue that was issued at par value and matures on January 1, 2016.On January 2, 2011, a portion of the bonds was purchased and constructively retired.

The interest income and expense eliminations relate to a $100,000, 9% bond issue that was issued at par value and matures on January 1, 2016.On January 2, 2011, a portion of the bonds was purchased and constructively retired.

Required: Answer the following questions.

1.Which company is the issuing affiliate of the bonds payable?

2.What is the gain or loss from the constructive retirement of the bonds payable that is reported on the consolidated income statement for 2011?

3.What portion of the bonds payable is held by nonaffiliates at December 31, 2011?

4.Is Sojourn a wholly-owned subsidiary? If not, what percentage does Pitta own?

5.Does the purchasing affiliate use straight-line or effective interest amortization?

6.Explain the calculation of Pitta's $19,900 income from Sojourn.

Definitions:

Effectiveness

The degree to which something is successful in producing a desired result or outcome.

Efficiency

The ratio of useful output to total input, used as a measure of the effectiveness of a system at converting inputs into useful outputs.

Exit Strategy

A planned approach to exiting a business or investment, to secure maximum value.

Research And Analysis

A systematic investigation and study of materials, sources, etc., in order to establish facts and reach new conclusions, often used in various professional fields.

Q2: Under the entity theory, a consolidated balance

Q10: Pomograte Corporation bought 75% of Sycamore Company's

Q13: Behd Company, a U.S.firm, sold some of

Q14: Controlling interest share in consolidated net income

Q19: Entities other than the primary beneficiary account

Q24: Stilt Corporation purchased a 40% interest in

Q26: Plymouth Corporation (a U.S.company)began operations on September

Q38: If the sale of the merchandise was

Q38: Under the entity theory, what amount of

Q132: A full-time student who is not working