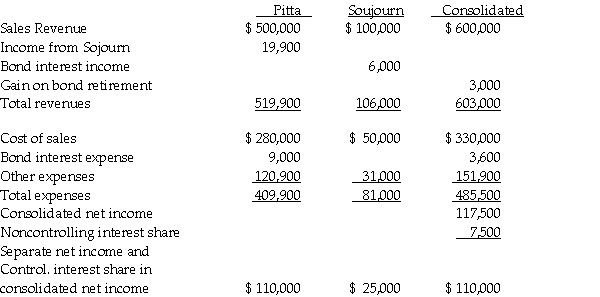

Separate company and consolidated income statements for Pitta and Sojourn Corporations for the year ended December 31, 2011 are summarized as follows:

The interest income and expense eliminations relate to a $100,000, 9% bond issue that was issued at par value and matures on January 1, 2016.On January 2, 2011, a portion of the bonds was purchased and constructively retired.

The interest income and expense eliminations relate to a $100,000, 9% bond issue that was issued at par value and matures on January 1, 2016.On January 2, 2011, a portion of the bonds was purchased and constructively retired.

Required: Answer the following questions.

1.Which company is the issuing affiliate of the bonds payable?

2.What is the gain or loss from the constructive retirement of the bonds payable that is reported on the consolidated income statement for 2011?

3.What portion of the bonds payable is held by nonaffiliates at December 31, 2011?

4.Is Sojourn a wholly-owned subsidiary? If not, what percentage does Pitta own?

5.Does the purchasing affiliate use straight-line or effective interest amortization?

6.Explain the calculation of Pitta's $19,900 income from Sojourn.

Definitions:

Transitory

Pertaining to or lasting for only a short period of time; temporary and fleeting in nature.

Unmodulated Color

A color that is consistent in hue and intensity across a surface, without gradation in tone or shade.

Medium

The material (for example, marble, bronze, clay, fresco) in which an artist works; also, in painting, the vehicle (usually liquid) that carries the pigment.

Humanity

The collective term for all human beings, or the qualities that characterize human beings, such as benevolence, compassion, and the ability to think and reason.

Q6: In computing consolidated diluted EPS, the replacement

Q7: Accounts representing an allowance for uncollectible accounts

Q20: A business merger differs from a business

Q25: Historically, much of the controversy concerning accounting

Q30: In a Chapter 11 case, the debtor

Q30: At December 31, 2012 year-end, Arnold Corporation's

Q31: Pashley Corporation purchased 75% of Sargent Corporation

Q36: Pass Corporation owns 80% of Sindy Company,

Q37: On January 1, 2011, Paste Unlimited, a

Q116: The unemployment rate in the United States