Use the following information to answer the question(s) below.

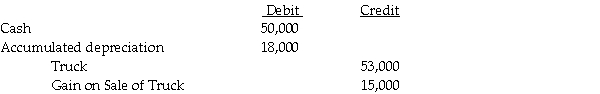

On January 1,2010,Shrimp Corporation purchased a delivery truck with an expected useful life of five years,and a salvage value of $8,000.On January 1,2012,Shrimp sold the truck to Pacet Corporation.Pacet assumed the same salvage value and remaining life of three years used by Shrimp.Straight-line depreciation is used by both companies.On January 1,2012,Shrimp recorded the following journal entry:

Pacet holds 60% of Shrimp.Shrimp reported net income of $55,000 in 2012 and Pacet's separate net income (excludes interest in Shrimp) for 2012 was $98,000.

Pacet holds 60% of Shrimp.Shrimp reported net income of $55,000 in 2012 and Pacet's separate net income (excludes interest in Shrimp) for 2012 was $98,000.

-In preparing the consolidated financial statements for 2012,the elimination entry for depreciation expense was a

Definitions:

Q5: If Bird uses the "actual-sale-date" sales assumption,

Q13: Ohio Corporation is being liquidated under Chapter

Q14: If a U.S.company is preparing a journal

Q21: The CPI is also referred to as<br>A)the

Q24: Phast Corporation owns a 80% interest in

Q31: Jabiru Corporation purchased a 20% interest in

Q124: Suppose your grandfather earned a salary of

Q183: Which of the following describes actual trends

Q186: Deflation occurs when<br>A)there is a sustained increase

Q259: The nominal interest rate minus the inflation