Use the following information to answer the question(s) below.

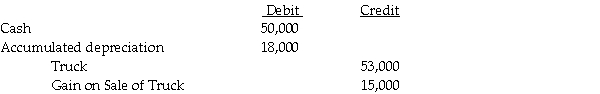

On January 1,2010,Shrimp Corporation purchased a delivery truck with an expected useful life of five years,and a salvage value of $8,000.On January 1,2012,Shrimp sold the truck to Pacet Corporation.Pacet assumed the same salvage value and remaining life of three years used by Shrimp.Straight-line depreciation is used by both companies.On January 1,2012,Shrimp recorded the following journal entry:

Pacet holds 60% of Shrimp.Shrimp reported net income of $55,000 in 2012 and Pacet's separate net income (excludes interest in Shrimp) for 2012 was $98,000.

Pacet holds 60% of Shrimp.Shrimp reported net income of $55,000 in 2012 and Pacet's separate net income (excludes interest in Shrimp) for 2012 was $98,000.

-Parrot Company owns all the outstanding voting stock of Southern Manufacturing.On January 1,2012,Parrot sold machinery to Southern at its book value of $24,000.Parrot had the machinery three years before selling it and used an eight-year straight-line depreciation method,with zero salvage value.Southern will use the straight-line depreciation method,and assumes the machine has five years remaining and no salvage value.In the 2012 consolidating working papers,the depreciation expense

Definitions:

Nonparametric Statistics

Statistics used with data that cannot be assumed to have a normal distribution.

T Test

A statistical test used to compare the means of two groups and determine if they are significantly different from each other.

Chi-square Test

A method of statistical analysis utilized to ascertain the presence of a meaningful relationship between two variables of a categorical nature.

T Test

A statistical test used to compare the means of two groups to determine if there is a significant difference between them.

Q9: Griffon Incorporated holds a 30% ownership in

Q15: When a cash flow hedge is appropriate,

Q20: We say that the economy is at

Q29: Samford Corporation's stockholders' equity on December 31,

Q33: Sally Corporation's stockholders' equity on December 31,

Q39: Patterson Company acquired 90% of Starr Corporation

Q141: Which of the following would reduce the

Q154: Suppose that in 2014,all prices in the

Q175: Refer to Table 9-11.Suppose an economy has

Q251: Suppose the government launches a successful advertising