Use the following information to answer the question(s) below.

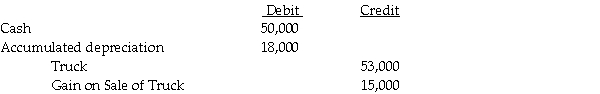

On January 1,2010,Shrimp Corporation purchased a delivery truck with an expected useful life of five years,and a salvage value of $8,000.On January 1,2012,Shrimp sold the truck to Pacet Corporation.Pacet assumed the same salvage value and remaining life of three years used by Shrimp.Straight-line depreciation is used by both companies.On January 1,2012,Shrimp recorded the following journal entry:

Pacet holds 60% of Shrimp.Shrimp reported net income of $55,000 in 2012 and Pacet's separate net income (excludes interest in Shrimp) for 2012 was $98,000.

Pacet holds 60% of Shrimp.Shrimp reported net income of $55,000 in 2012 and Pacet's separate net income (excludes interest in Shrimp) for 2012 was $98,000.

-Assume an upstream sale of machinery occurs on January 1,2011.The parent owns 70% of the subsidiary.There is a gain on the intercompany transfer and the machine has five remaining years of useful life and no salvage value.Straight-line depreciation is used.Which of the following statements is correct?

Definitions:

Q2: Which of the following does not occur

Q2: For 2010 and 2011, Sabil Corporation earned

Q5: Bond Interest Receivable for 2011 of Pfadt's

Q13: Alf, Bill, Cam, and Dot are partners

Q25: Bonds Payable appeared in the December 31,

Q32: On January 1, 2011, Placid Corporation acquired

Q36: Partnerships<br>A) are required to prepare annual reports.<br>B)

Q38: Jersey Company acquired 90% of York Company

Q155: The inflation rate measures the percentage increase

Q284: What is the difference between the nominal