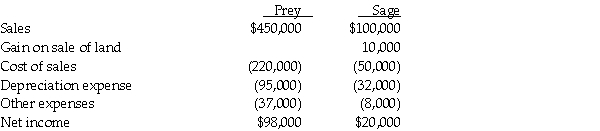

Prey Corporation created a wholly owned subsidiary, Sage Corporation, on January 1, 2010, at which time Prey sold land with a book value of $90,000 to Sage at its fair market value of $140,000.Also, on January 1, 2010, Prey sold to Sage equipment with a book value of $130,000 and a selling price of $165,000.The equipment had a remaining useful life of 4 years and is being depreciated under the straight-line method.The equipment has no salvage value.On January 1, 2012, Sage resold the land to an outside entity for $150,000.Sage continues to use the equipment purchased from Prey.Income statements for Prey and Sage for the year ended December 31, 2012 are summarized below:

Required:

Required:

At what amounts did the following items appear on the consolidated income statement for Prey and Subsidiary for the year ended December 31, 2012?

1.Gain on Sale of Land

2.Depreciation Expense

3.Consolidated net income

4.Controlling interest share of consolidated net income

Definitions:

Set-Aside Program

Component of a government contract specifying that certain government contracts (or portions of those contracts) are restricted to small businesses and/or to women- or minority-owned companies.

Government Contracts

are agreements entered between companies and government entities for the provision of goods and services.

Qualifying Small Businesses

Refers to small businesses that meet specific criteria set by government or financial entities to be eligible for benefits or incentives.

Business Plan

A document that outlines a company's goals, the strategy to achieve them, financial forecasts, and market analysis.

Q1: A primary difference between voluntary and involuntary

Q15: Why would a firm pay efficiency wages?

Q23: In general, GAAP encourages the identification of

Q26: Palm owns a 70% interest in Sable,

Q32: At the end of 2010, the partnership

Q33: Using a safe payments schedule, how much

Q79: When the labor market is at full

Q142: If the number employed is 190 million,the

Q172: Refer to Table 9-14.The real average hourly

Q290: Mike has been unemployed for over a