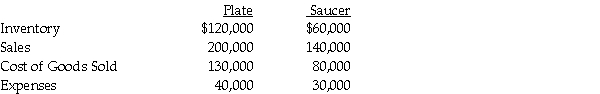

Presented below are several figures reported for Plate Corporation and Saucer Industries as of December 31, 2011.Plate has owned 70% of Saucer for the past five years, and at the time of purchase, the book value of Saucer's assets and liabilities equaled the fair value.The cost of the 70% investment was equal to 70% of the book value of Saucer's net assets.At the time of purchase, the fair values and book values of Saucer's assets and liabilities were equal.

In 2010, Saucer sold inventory to Plate which had cost $40,000 for $60,000.25% of this inventory remained on hand at December 31, 2010, but was sold in 2011.In 2011, Saucer sold inventory to Plate which had cost $30,000 for $45,000.40% of this inventory remained unsold at December 31, 2011.

In 2010, Saucer sold inventory to Plate which had cost $40,000 for $60,000.25% of this inventory remained on hand at December 31, 2010, but was sold in 2011.In 2011, Saucer sold inventory to Plate which had cost $30,000 for $45,000.40% of this inventory remained unsold at December 31, 2011.

Required: Calculate following balances at December 31, 2011.

a.Consolidated Sales

b.Consolidated Cost of goods sold

c.Consolidated Expenses

d.Noncontrolling interest share of Saucer's net income

e.Consolidated Inventory

Definitions:

Satisfactions Of Caregiving

The positive emotional rewards and fulfillment individuals may experience when providing care to others.

Labor Of Love

Work or effort done for the sake of passion or deep interest, not for financial gain or duty.

Family Relationships

The connections and bonds among members of a family, whether by blood, marriage, or adoption.

Family Care Giving

The act of providing physical, emotional, or financial support to relatives who are aging, ill, or disabled, often involving significant personal sacrifice.

Q1: Parker Corporation owns an 80% interest in

Q16: For internal decision-making purposes, Falcon Corporation identifies

Q16: Plower Corporation acquired all of the outstanding

Q19: Separate income statements of Plantation Corporation and

Q29: Barnes Company entered into a forward contract

Q31: Drawings<br>A) are advances to a partnership.<br>B) are

Q38: For internal decision-making purposes, Geogh Corporation identifies

Q73: In 2013,Caterpillar laid off employees.The employees who

Q109: In the modern U.S.economy,the typical unemployed person

Q238: An unemployment insurance program has which of