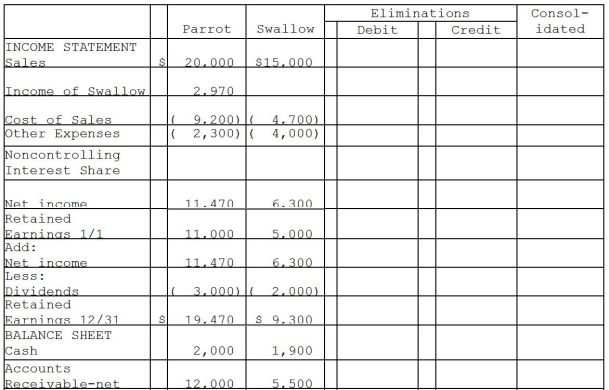

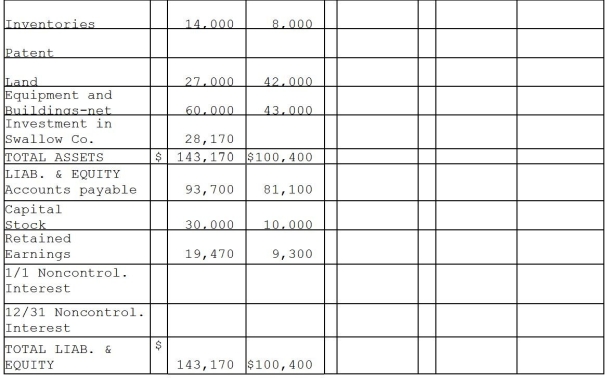

Parrot Corporation acquired 90% of Swallow Co.on January 1, 2011 for $27,000 cash when Swallow's stockholders' equity consisted of $10,000 of Capital Stock and $5,000 of Retained Earnings.The difference between the fair value and book value of Swallow's net assets was allocated solely to a patent amortized over 5 years.The separate company statements for Parrot and Swallow appear in the first two columns of the partially completed consolidation working papers.

Required:

Complete the consolidation working papers for Parrot and Swallow for the year 2011.

Definitions:

Responsibility Centres

Units or departments within an organization, each with specific responsibilities and performance metrics to manage financial outcomes.

Imputed Interest Rate

The estimated rate of interest, often applied in situations where no actual interest rate is specified in a financial transaction.

Required Rate of Return

The minimum annual percentage earned by an investment that will entice individuals or companies to put money into a particular security or project.

Invested Capital

Represents the total amount of money invested into a business by its owners and creditors, used for ongoing business operations.

Q1: Padhy Corporation owns 80% of Abrams Corporation,

Q1: Phim Inc., a U.S.company, owns 100% of

Q7: The accountant for Baxter Corporation has assigned

Q13: Pittle Corporation acquired a 80% interest in

Q15: Using the original information, the balances for

Q16: Plower Corporation acquired all of the outstanding

Q16: For 2010, 2011, and 2012, Squid Corporation

Q34: If the average capital for Bertram and

Q135: Which of the following would increase gross

Q224: Which of the following is not a