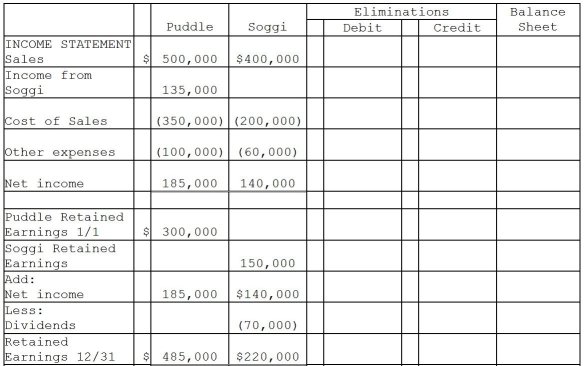

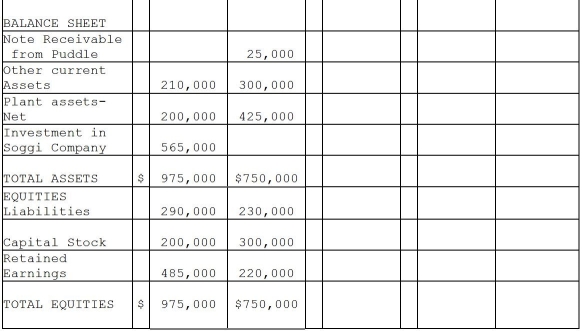

Puddle Corporation acquired all the voting stock of Soggi Company for $500,000 on January 1, 2011 when Soggi had Capital Stock of $300,000 and Retained Earnings of $150,000.The book value of Soggi's assets and liabilities were equal to the fair value except for the plant assets.The entire cost-book value differential is allocated to plant assets and is fully depreciated on a straight-line basis over a 10-year period.

During 2011, Puddle borrowed $25,000 on a short-term non-interest-bearing note from Soggi, and on December 31, 2011, Puddle mailed a check to Soggi to settle the note.Soggi deposited the check on January 5, 2012, but receipt of payment of the note was not reflected in Soggi's December 31, 2011 balance sheet.

Required:

Complete the consolidation working papers for the year ended December 31, 2011.

Definitions:

Standard Deviation

A measurement indicating the range of separation or variance among a set of data.

Mean

The arithmetic average of a set of numbers, calculated by adding all the numbers and dividing by the count.

Standard Normal Curve

A bell-shaped curve that is symmetric about the mean, showing the distribution of a standard normal variable where the mean is zero and the standard deviation is one.

Z-score

A statistic that measures the distance of a single data point from the mean, expressed in units of standard deviation.

Q1: How does GAAP view interim accounting periods?<br>A)

Q8: Refer to Scenario 8-1.The value added of

Q20: We say that the economy is at

Q32: What is the amount of consolidated Retained

Q35: The partners of the Minion, Nocti and

Q39: Patterson Company acquired 90% of Starr Corporation

Q241: Assume the average annual CPI values for

Q267: The natural rate of unemployment consists of

Q273: The cost to firms of changing prices<br>A)is

Q276: Refer to Table 9-1.The labor force participation