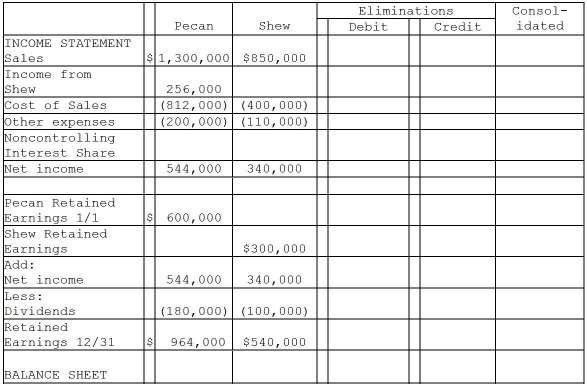

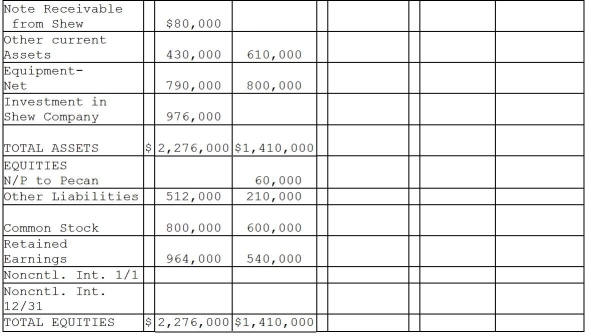

Pecan Incorporated acquired 80% of the voting stock of Shew Manufacturing for $800,000 on January 2, 2011 when Shew had outstanding common stock of $600,000 and Retained Earnings of $300,000.The book value and fair value of Shew's assets and liabilities were equal except for equipment.The entire fair value/book value differential is allocated to equipment and is fully depreciated on a straight-line basis over a 5-year period.

During 2011, Shew borrowed $80,000 on a short-term non-interest-bearing note from Pecan, and on December 31, 2011, Shew mailed a check for $20,000 to Pecan in partial payment of the note.Pecan deposited the check on January 4, 2012, and recorded the entry to reduce the note balance at that time.

Required:

Complete the consolidation working papers for the year ended December 31, 2011.

Definitions:

Market Risk Premium

The additional return an investor expects to receive from an equity investment over the risk-free rate, as compensation for taking on higher risk.

Risk-Free Rate

The Risk-Free Rate is the theoretical return on an investment with no risk of financial loss, typically associated with government bonds.

Beta

A measure of a stock's volatility in relation to the overall market, indicating its risk compared to the market.

Flotation Costs

Expenses incurred by a company in issuing new securities, including underwriting fees, legal costs, and registration fees.

Q4: Gains or losses on foreign currency transactions

Q10: A forward contract used as a cash

Q15: Bigga Corporation purchased the net assets of

Q18: A review of Ace Industries, a U.S.corporation,

Q24: Snow Company is a wholly owned subsidiary

Q27: What method of accounting will generally be

Q32: What is the amount of consolidated Retained

Q32: Pogo Corporation acquired a 75% interest in

Q34: The exchange rates between the Australian dollar

Q175: Which of the following goods is directly