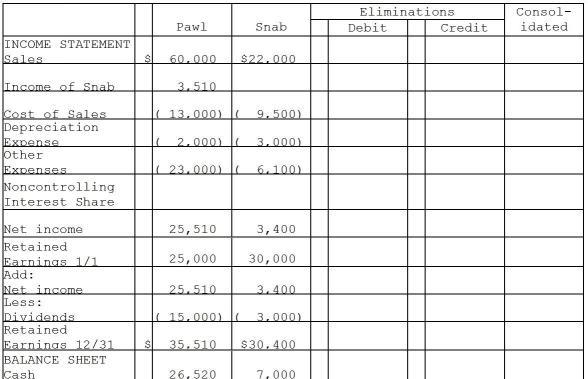

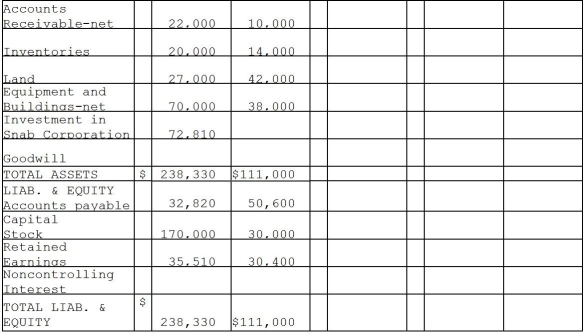

Pawl Corporation acquired 90% of Snab Corporation on January 1, 2011 for $72,000 cash when Snab's stockholders' equity consisted of $30,000 of Capital Stock and $30,000 of Retained Earnings.The difference between the fair value of Pawl's assets and liabilities and the book value was allocated to a plant asset with a remaining 10-year straight-line life that was overvalued on the books by $5,000.The remainder was attributable to goodwill.The separate company statements for Pawl and Snab appear in the first two columns of the partially completed consolidation working papers.

Required:

Complete the consolidation working papers for Pawl and Snab for the year 2011.

Definitions:

Inventory Items

Goods and materials that a business holds for the ultimate goal of resale or production.

List Price

The suggested retail price of a product or service, before any discounts or adjustments.

Delivery Truck

A vehicle specifically designed and used for transporting goods from one location to another.

Undepreciated Cost

The original cost of an asset minus any accumulated depreciation.

Q4: Pfeifer Corporation acquired an 80% interest in

Q4: Piglet Incorporated purchased 90% of the outstanding

Q8: On December 31, 2011, Maria Corporation has

Q20: Phlora purchased its 100% ownership in Speshal

Q37: What amount of Inventory will be reported?<br>A)

Q38: Under the entity theory, what amount of

Q102: The labor force participation rates of women

Q207: Eliminating structural unemployment would be good for

Q241: Assume the average annual CPI values for

Q280: The short-term unemployment arising from the process