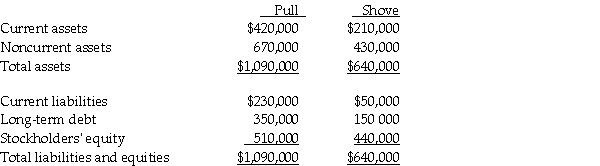

Pull Incorporated and Shove Company reported summarized balance sheets as shown below, on December 31, 2011.

On January 1, 2012, Pull purchased 70% of the outstanding capital stock of Shove for $392,000, of which $92,000 was paid in cash, and $300,000 was borrowed from their bank.The debt is to be repaid in 10 annual installments beginning on December 31, 2012, with each payment consisting of $30,000 principal, plus accrued interest.

On January 1, 2012, Pull purchased 70% of the outstanding capital stock of Shove for $392,000, of which $92,000 was paid in cash, and $300,000 was borrowed from their bank.The debt is to be repaid in 10 annual installments beginning on December 31, 2012, with each payment consisting of $30,000 principal, plus accrued interest.

The excess fair value of Shove Company over the underlying book value is allocated to inventory (60 percent)and to goodwill (40 percent).

Required: Calculate the balance in each of the following accounts, on the consolidated balance sheet, immediately following the acquisition.

a.Current assets

b.Noncurrent assets

c.Current liabilities

d.Long-term debt

e.Stockholders' equity

Definitions:

Medical Research Projects

Scientific studies undertaken with the aim of expanding knowledge in fields related to medicine and healthcare.

Consent

Agreement or permission given voluntarily by a competent individual, fully informed of the risks and benefits.

Clear Benefits

Advantages or positive outcomes that are distinct and readily apparent.

Peter Singer

A philosopher best known for his work in bioethics and his advocacy for animal rights and utilitarianism.

Q10: What is the final amount of the

Q13: The amount of income for the current

Q18: According to FASB Statement 141R, which one

Q21: On December 31, 2011, Lorna Corporation has

Q30: At December 31, 2012 year-end, Arnold Corporation's

Q131: The Bureau of Labor Statistics counts as

Q203: What effect does the payment of government

Q204: During the month of May,10 million workers

Q275: The Bureau of Labor Statistics would categorize

Q278: Minimum wage laws cause unemployment because the