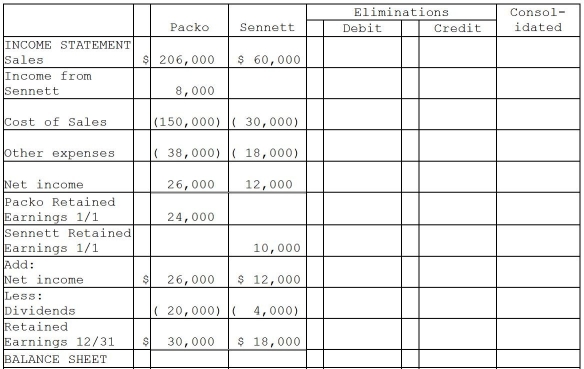

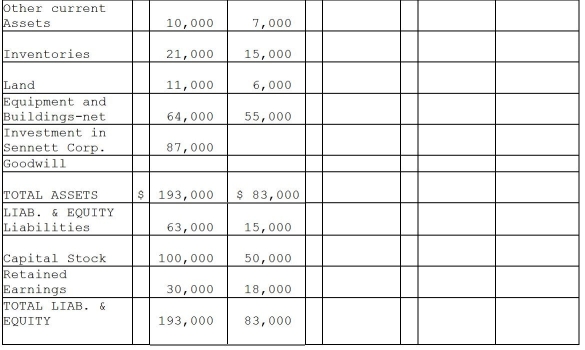

Packo Company acquired all the voting stock of Sennett Corporation on January 1, 2010 for $90,000 when Sennett had Capital Stock of $50,000 and Retained Earnings of $8,000.The excess of fair value over book value was allocated as follows: (1)$5,000 to inventories(sold in 2010), (2)$16,000 to equipment with a 4-year remaining useful life(straight-line method of depreciation)and (3)the remainder to goodwill.

Financial statements for Packo and Sennett at the end of the fiscal year ended December 31, 2011 (two years after acquisition), appear in the first two columns of the partially completed consolidation working papers.Packo has accounted for its investment in Sennett using the equity method of accounting.

Required:

Complete the consolidation working papers for Packo Company and Subsidiary for the year ending December 31, 2011.

Definitions:

Q2: During a deflationary period,<br>A)the nominal interest rate

Q18: Palk Corporation has a foreign subsidiary located

Q31: Cirtus Corporation, a U.S.corporation, placed an order

Q33: What method of accounting will generally be

Q40: The "new product bias" in the consumer

Q40: The table below provides either a direct

Q98: If inflation is completely anticipated,<br>A)no one loses

Q122: An advantage of the establishment survey over

Q172: Refer to Table 9-14.The real average hourly

Q240: Which of the following cause the unemployment