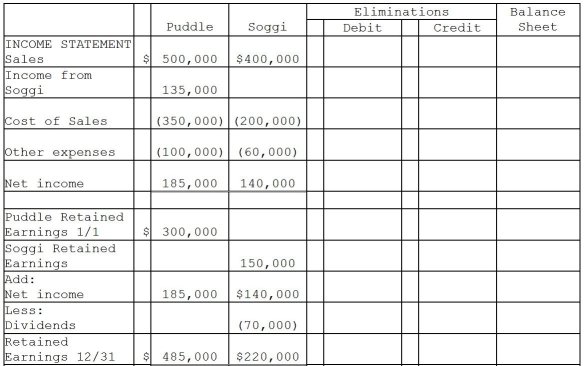

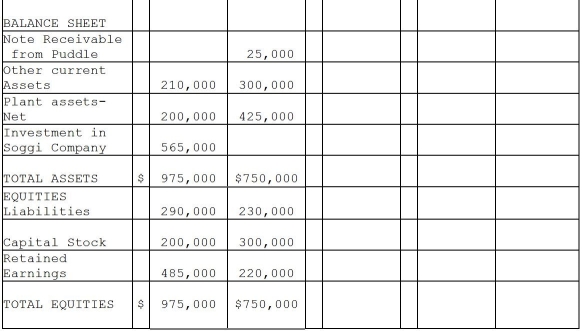

Puddle Corporation acquired all the voting stock of Soggi Company for $500,000 on January 1, 2011 when Soggi had Capital Stock of $300,000 and Retained Earnings of $150,000.The book value of Soggi's assets and liabilities were equal to the fair value except for the plant assets.The entire cost-book value differential is allocated to plant assets and is fully depreciated on a straight-line basis over a 10-year period.

During 2011, Puddle borrowed $25,000 on a short-term non-interest-bearing note from Soggi, and on December 31, 2011, Puddle mailed a check to Soggi to settle the note.Soggi deposited the check on January 5, 2012, but receipt of payment of the note was not reflected in Soggi's December 31, 2011 balance sheet.

Required:

Complete the consolidation working papers for the year ended December 31, 2011.

Definitions:

Indwelling Catheter

A catheter that remains inside the body for extended periods, used to drain urine or administer medication.

Timed Urine

A method of collecting all urine produced and expelled by the body over a specific period for diagnostic purposes.

Collection Bottle

A receptacle used for collecting and storing fluids or samples in medical settings.

Gastric Secretions

Fluids produced by the stomach, including hydrochloric acid and digestive enzymes, that aid in food digestion.

Q2: During a deflationary period,<br>A)the nominal interest rate

Q10: Pigeon Corporation purchased land from its 60%-owned

Q10: Goodwill arising from a business combination is<br>A)

Q20: A parent company regularly sells merchandise to

Q23: The consolidated income statement for Pouch Corporation

Q23: The controlling interest share of consolidated net

Q25: Par Industries, a U.S.Corporation, purchased Slice Company

Q64: Discouraged workers are classified by the BLS

Q152: Full employment is not considered to be

Q168: The PPI is the<br>A)price parity index.<br>B)prime producer