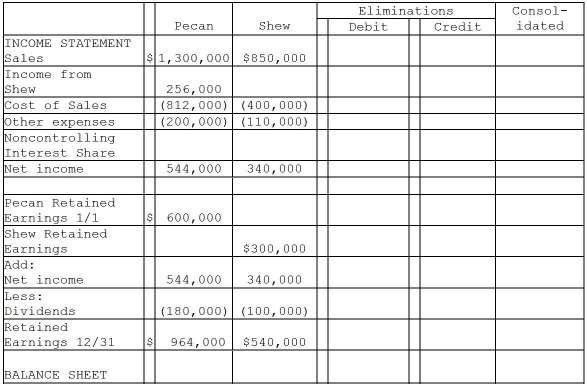

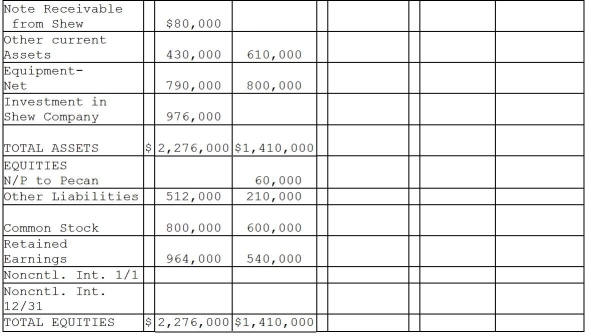

Pecan Incorporated acquired 80% of the voting stock of Shew Manufacturing for $800,000 on January 2, 2011 when Shew had outstanding common stock of $600,000 and Retained Earnings of $300,000.The book value and fair value of Shew's assets and liabilities were equal except for equipment.The entire fair value/book value differential is allocated to equipment and is fully depreciated on a straight-line basis over a 5-year period.

During 2011, Shew borrowed $80,000 on a short-term non-interest-bearing note from Pecan, and on December 31, 2011, Shew mailed a check for $20,000 to Pecan in partial payment of the note.Pecan deposited the check on January 4, 2012, and recorded the entry to reduce the note balance at that time.

Required:

Complete the consolidation working papers for the year ended December 31, 2011.

Definitions:

Q6: A foreign entity is a subsidiary of

Q8: Several years ago, Peacock International purchased 80%

Q10: What is the final amount of the

Q22: Peter Corporation owns a 70% interest in

Q31: The natural rate of unemployment consists of

Q31: If the sale of merchandise is denominated

Q34: Pachelor Corporation owns 70% of the outstanding

Q122: An advantage of the establishment survey over

Q210: Refer to Table 9-19.Looking at the table

Q254: Refer to Figure 9-1.Based on the graph