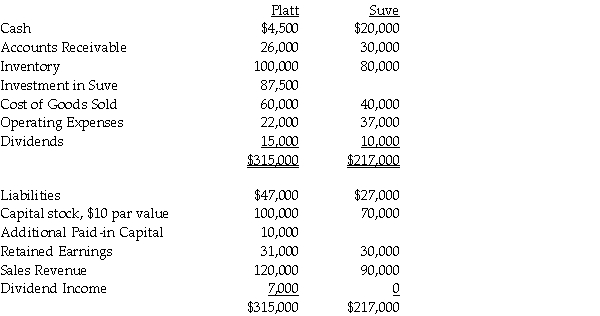

Platt Corporation paid $87,500 for a 70% interest in Suve Corporation on January 1, 2011, when Suve's Capital Stock was $70,000 and its Retained Earnings $30,000.The fair values of Suve's identifiable assets and liabilities were the same as the recorded book values on the acquisition date.Trial balances at the end of the year on December 31, 2011 are given below:

During 2011, Platt made only two journal entries with respect to its investment in Suve.On January 1, 2011, it debited the Investment in Suve account for $87,500 and on November 1, 2011, it credited Dividend Income for $7,000.

During 2011, Platt made only two journal entries with respect to its investment in Suve.On January 1, 2011, it debited the Investment in Suve account for $87,500 and on November 1, 2011, it credited Dividend Income for $7,000.

Required:

1.Prepare a consolidated income statement and a statement of retained earnings for Platt and Subsidiary for the year ended December 31, 2011.

2.Prepare a consolidated balance sheet for Platt and Subsidiary as of December 31, 2011.

Definitions:

Quality Information

Data or facts that are accurate, reliable, and relevant to the context or requirement.

Literature Search

The comprehensive exploration and review of published academic contributions on a specific topic or question.

Relevant Information

Data or facts that are directly related and helpful in the evaluation or decision-making process regarding a specific question or problem.

Quality Information

Data or content that is accurate, reliable, relevant, and timely, meeting the specific needs of users.

Q11: Partridge Corporation purchased an 80% interest in

Q18: Assume a company's preferred stock is cumulative

Q22: Palomba Corporation allocates consolidated income taxes to

Q27: On June 30, 2011, Stampol Company ceased

Q27: On July 1, 2011, Joe, Kline, and

Q28: Wader's Corporation paid $120,000 for a 25%

Q32: On January 1, 2012, Pauline Company acquired

Q80: Which of the following describes a situation

Q243: The factors of production include<br>A)wages.<br>B)capital.<br>C)investment.<br>D)transfers.

Q259: Refer to Table 8-5.The value of each