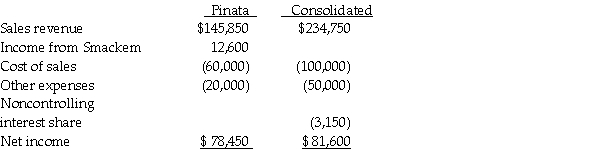

Pinata Corporation acquired an 80% interest in Smackem Inc.for $130,000 on January 1, 2011, when Smackem had Capital Stock of $125,000 and Retained Earnings of $25,000.Assume the fair value and book value of Smackem's net assets were equal on January 1, 2011.Pinata's separate income statement and a consolidated income statement for Pinata and Subsidiary as of December 31, 2011, are shown below.  Smackem's separate income statement must have reported net income of

Smackem's separate income statement must have reported net income of

Definitions:

Monozygotic Twins

Twins that develop from a single fertilized egg, sharing identical genetic material.

Identical Twins

Twins that originate from a single fertilized egg, splitting and developing into two genetically identical individuals.

Allele

A member of a pair of genes.

Homozygous Trait

A genetic condition where an individual inherits identical alleles for a particular gene from both parents.

Q4: Gains or losses on foreign currency transactions

Q5: If Bird uses the "actual-sale-date" sales assumption,

Q11: On December 31, 2011, Paladium International purchased

Q11: Partridge Corporation purchased an 80% interest in

Q28: The average price of goods and services

Q29: Required:<br>1.Prepare a schedule to allocate income to

Q29: On January 1, 2011, Jeff Company acquired

Q29: Pearl Corporation paid $150,000 on January 1,

Q32: Macroeconomics,as opposed to microeconomics,includes the study of

Q174: Suppose that homemakers are included as employed