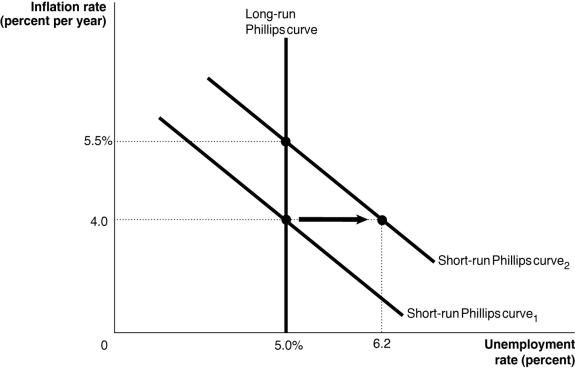

Figure 17-4

-Refer to Figure 17-4.Consider the shift in the short-run Phillips curves shown in the above graph.This shift may be explained by

Definitions:

Inflation Rate

The velocity at which there is a general increase in the cost of goods and services, thereby reducing the effective purchasing capability.

Compound Interest CSB

The calculation of interest on a Canada Savings Bond (CSB) where interest earned also earns interest over time.

Redemption Value

The value at which a bond or other debt instrument can be redeemed before its maturity by the issuer.

Compound-Interest GIC

A Guaranteed Investment Certificate (GIC) where interest is compounded periodically and added to the principal balance, leading to interest earnings on interest.

Q12: Suppose real GDP is $12.1 trillion and

Q62: Why might a developing country choose to

Q67: Expansionary monetary policy lowers interest rates and

Q80: Which of the following would increase the

Q82: If the Phillips curve represents a "structural

Q85: If the government purchases multiplier equals 2,and

Q195: Monetary policy can<br>A)shift the short-run trade-off between

Q215: When President Obama took office in January

Q226: As a percentage of GDP,federal expenditures _

Q241: A decrease in the marginal income tax