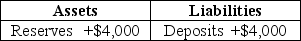

Table 14-1

-Refer to Table 14-1.Suppose a transaction changes a bank's balance sheet as indicated in the T-account,and the required reserve ratio is 10 percent.As a result of the transaction,the bank has excess reserves of

Definitions:

Variable Cost

Outlays that shift in alignment with the quantity of output generated.

Discount Rate

The interest rate used to discount future cash flows of a financial instrument back to their present value, thus reflecting the cost of capital.

Initial Cost

The upfront expense incurred to purchase an asset or start a project, including all relevant expenses.

Cash Inflows

Money coming into a business, typically from operations, financing, or investing activities; crucial for maintaining liquidity.

Q41: All of the following are reasons why

Q67: If bankers become more uncertain regarding future

Q125: Which of the following would cause the

Q189: Refer to Table 14-3.Consider the following simplified

Q198: When the Federal Reserve increases the money

Q204: If the required reserve ratio is 100

Q208: What are the implications of the quantity

Q239: The tax wedge is the difference between

Q242: Why does the short-run aggregate supply curve

Q283: In Year 1 suppose the economy is