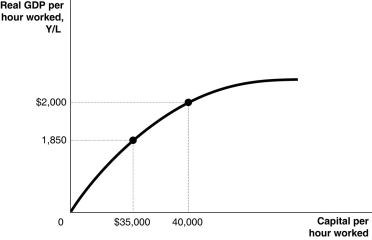

Figure 11-2

-Refer to Figure 11-2.Assuming no technological change,if the United States increases capital per hour worked by $40,000 every year between 2010 and 2014,we would expect to see

Definitions:

Contestable Markets

Markets where the threat of potential entry by competitors influences the behavior and pricing of existing firms.

Perfectly Competitive

A market structure characterized by a large number of small firms, homogenous products, perfect information, and free entry and exit, leading to price taking behavior.

Five Forces Model

A framework developed by Michael Porter to analyze the level of competition within an industry and business strategy development, which includes the threat of new entrants, the threat of substitutes, the bargaining power of buyers, the bargaining power of suppliers, and competitive rivalry.

Product Differentiation

The process of distinguishing a product or service from others to make it more attractive to a particular target market.

Q12: Relative to productivity growth in the United

Q61: Refer to Figure 10-6.The loanable funds market

Q106: The main result of the monetarist model

Q117: According to the World Bank,Albania does one

Q124: Explain three reasons why the productivity slowdown

Q186: John Maynard Keynes argued that if many

Q188: Technological advances generally result in<br>A)decreased incomes.<br>B)increased life

Q194: According to the "Rule of 70," how

Q201: If real GDP per capita doubles between

Q235: Actual investment spending does not include<br>A)spending on