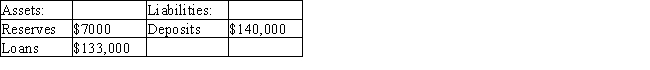

Table 10-4

The following information pertains to the Bank of Moncton.

-Refer to the Table 10-4.If the Bank of Canada requires a reserve ratio of 4 percent,how much in excess reserves does the Bank of Moncton now hold?

Definitions:

Gross Margin Percentage

A profitability metric expressed as a percentage, calculated by subtracting the cost of goods sold from sales revenue and dividing the result by sales revenue.

Net Profit Margin

The percentage of revenue remaining after all operating expenses, interest, taxes, and preferred stock dividends have been deducted from a company's total revenue.

Return on Assets

A measure of a company's profitability relative to its total assets, indicating how efficiently a company uses its assets to generate earnings.

Cost of Borrowing

The total charges, including interest and any other fees, that a borrower pays to secure and use borrowed money.

Q19: What is a role of the Minister

Q32: Refer to Table 8-1.Assume that the closing

Q34: Suppose the banking system has $10 million

Q38: Suppose that the reserve ratio is 7

Q71: The country of Freedonia has a GDP

Q76: Which statement best defines the bank rate?<br>A)

Q83: What is the approximate labour-force participation rate

Q153: If currency is $50 billion,chequable deposits $700

Q187: A bank has $200 reserves,$800 loans,$400 securities,$1200

Q209: What does stock represent?<br>A) certificate of insurance<br>B)