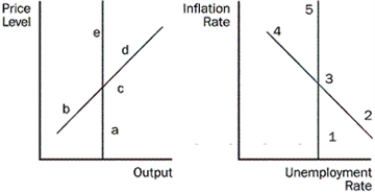

Figure 16-3

-Refer to the Figure 16-3.When would the economy move from c and 3 to b and 2?

Definitions:

M&M Proposition II

This financial theory, originating from Modigliani and Miller, states that a firm's cost of equity increases as the firm increases its level of debt financing, holding everything else constant.

Capital Structure

The mix of different forms of financial securities used by a firm to finance its operations, typically consisting of debt and equity.

Levered Firm

A company that has debt in its capital structure, implying that it has taken on borrowing to finance its operations or growth.

Unlevered Firm

A business or company that operates without any debt financing, meaning it does not have any borrowings in its capital structure.

Q1: If the short-run Phillips curve were stable,what

Q3: Why is the aggregate-supply curve upward sloping

Q26: Refer to the Figure 16-4.Along SRPC3,what is

Q27: Why does Canadian public policy discourage saving?<br>A)

Q45: Assuming no crowding-out,investment-accelerator,or multiplier effects,how will a

Q68: Among other things,what determines the long-run average

Q73: An increase in the price level shifts

Q97: Which of the following shifts the short-run

Q137: What has been suggested as a reason

Q195: If policymakers expand aggregate demand,what happens to