Marsha Cook owns Marsha's Pie Co. On January 2, 2010, the company purchased an oven for $325,000. The manufacturer of the oven estimates that the oven will last 12 years or bake 600,000 pies, with a residual value of $25,000.

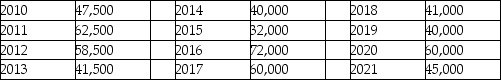

The following is a schedule of the pies that the company will produce:

Calculate the accumulated depreciation and book value as of December 31, 2016, using the units of production method.

Calculate the accumulated depreciation and book value as of December 31, 2016, using the units of production method.

Definitions:

Subjective

Based on personal feelings, tastes, or opinions rather than external facts or evidence.

Biases

Systematic and often unfair inclinations or prejudgements towards particular people, groups, or ideas.

Objective Tests

Assessments that measure an individual's psychological attributes using procedures that minimize subjective judgment, ensuring that results are scored in an unbiased or uniform manner.

Precise Numerical

Involving or characterized by exactness and accuracy in the use or presentation of numbers.

Q12: Accepting credit cards can increase revenue for

Q27: Elimination entries are required in order for

Q40: Under a perpetual inventory system, when a

Q102: Milton Company owns 30% interest in the

Q122: Under the direct write-off method, uncollectible-account expense

Q123: The following data was extracted from the

Q124: Stock investments that are to be sold

Q191: Gains on the sale of equipment increase

Q199: Accumulated depreciation is credited for the amount

Q200: Immediately after the last interest payment, Henderson