Martin Motors purchased a machine that will help diagnose problems with engines. The machine cost $210,000 on January 10, 2010 and a residual value of $10,000 was anticipated, with a useful life of 5 years. These statistics are available:

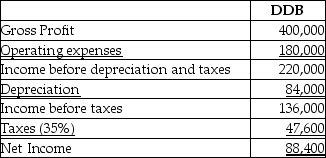

Martin Motors realized at the beginning of 2012 that the machine would last an additional 8 years. Martin Motors uses the DDB method.

Martin Motors realized at the beginning of 2012 that the machine would last an additional 8 years. Martin Motors uses the DDB method.

Prepare the appropriate journal entry to record the depreciation expense for 2012.

Definitions:

Prisoner's Dilemma

A fundamental problem in game theory showing why two individuals might not cooperate, even if it is in both their best interests to do so.

Slave-making Ants

Ant species that invade the colonies of other ants, capturing and forcing the captured ants to work for them.

Defection

The act of deserting a party, cause, or alliance, especially in a political or military context.

Honeyguides

A group of birds known for their unique behavior of leading humans or other animals to beehives, where they feed on the wax and bee larvae.

Q10: The amount of revenue to be recognized

Q44: The conservatism principle dictates that inventory be

Q47: Godert Pharmaceutical Company has many scientists working

Q61: Tom Golden, the accountant for Beauty Galore,

Q91: The process of allocating the cost of

Q102: Milton Company owns 30% interest in the

Q117: On January 2, 2012, Heidi's Pet Boutique

Q139: A gain or loss on the sale

Q148: A disadvantage of using bonds as a

Q164: Equipment acquired on January 1, 2010, is