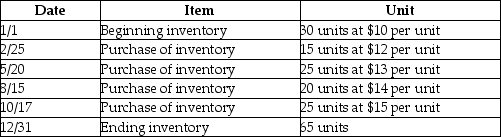

Given the following data, calculate the cost of ending inventory using the FIFO costing method.

Definitions:

Cost of Goods Sold

Cost of Goods Sold (COGS) represents the direct costs attributable to the production of goods sold by a company, including material and labor costs.

Stockholders' Equity

The residual interest in the assets of a corporation that remains after deducting its liabilities, representing ownership equity.

Net Income

The amount of money a firm earns after deducting all its expenses, taxes, and costs from its total revenue, indicating its profitability during a specific period.

Inventory On Credit

This refers to inventory purchased by a company for which payment is deferred to a later date, typically impacting the accounts payable.

Q34: A bank loaned Customer D $5,000. On

Q60: Complete the following chart by filling in

Q60: When preparing a bank reconciliation, several terms

Q138: Exception reporting is used in operating and

Q146: Goodwill occurs when a parent company:<br>A) pays

Q148: A depreciation method in which an equal

Q149: A petty cash fund:<br>A) is established to

Q170: When comparing the results of LIFO and

Q173: ABC Store sells expensive watches. An inventory

Q194: On June 1, 2011, Conqueror Company purchased